Dear teman-teman,

Menjelang akhir tahun 2008, disaat market mulai bergerak fluktuatif, dimana hal ini memberikan peluang sekaligus tantangan. Untuk itu kami akan mengadakan Workshop :

" Menggunakan TA dalam Trading"

Pada hari : Sabtu, 20 Desember 2008

Waktu : 09.00 - 16.00

Tempat :

Hotel Menara Peninsula, Merica Room (lt.2), Slipi, Jakarta Barat (di depan Slipi Jaya Mall)

Materi dan Pembicara :

Konsep dasar Trading (JH)

Trend Analysis (Kalipatullah/ Pengamat Market)

Chart Pattern (Hans)

Volume Anlysis (JSX Trader)

Indicator Analysis (Tasrul T)

Biaya : Rp. 700.000,- (cofee break, pengajar dan materi, lunch) discount 10% untuk member.

Info : cenayank_saham@ yahoo.com, Juliantikah@ yahoo.com

+62 21 92642107

Terima kasih atas waktu dan perhatiannya.

Salam,

JH

New Website www.trend-traders.com

Website baru dengan

bisa dibuka di:

http://trend-traders.com/

bisa dibuka di:

http://trend-traders.com/

The Trend Trader

Minggu, 30 November 2008

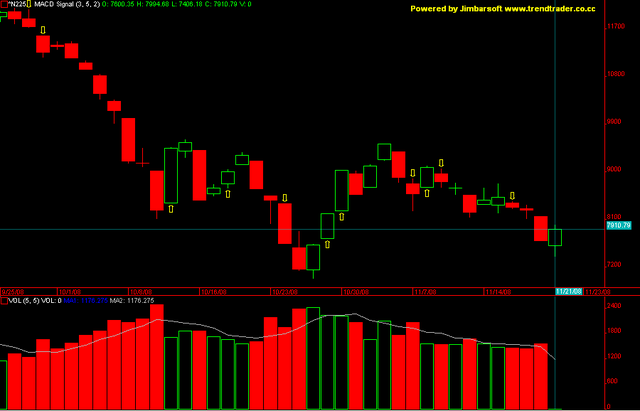

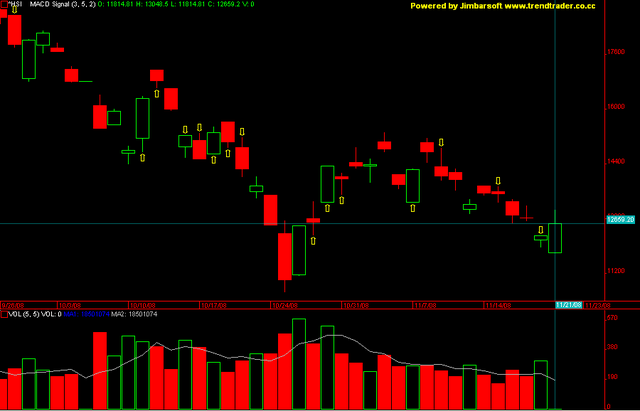

IHSG movement (December 2008)

Dalam posting sebelumnya tentang IHSG bull yang tanpa alasan dan komentar-komentar berikut saya sertakan alasan-alasan dan komentar2 dari IHSG bull

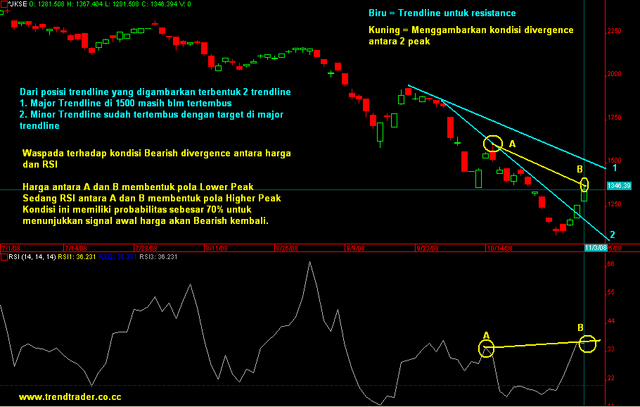

1. Terbentuk pola double bottom with bullish divergence

2. Golden Cross MACD Signal

Disclaimer:

Analisa diatas dibuat berdasarkan view dan pandangan pribadi menggunakan teknikal analisa, analisa diatas hanya merupakan bagian kecil dari metode trading. dan bukanlah merupakan untuk menjual atau membeli di market. Tetap sesuaikan metode trading dan investasi anda dengan modal dan kemampuan menahan resiko yang anda miliki

Semoga Bermanfaat

Kind Regards,

Aditya

1. Terbentuk pola double bottom with bullish divergence

2. Golden Cross MACD Signal

Disclaimer:

Analisa diatas dibuat berdasarkan view dan pandangan pribadi menggunakan teknikal analisa, analisa diatas hanya merupakan bagian kecil dari metode trading. dan bukanlah merupakan untuk menjual atau membeli di market. Tetap sesuaikan metode trading dan investasi anda dengan modal dan kemampuan menahan resiko yang anda miliki

Semoga Bermanfaat

Kind Regards,

Aditya

EUR/USD & USD/JPY analysis (Target and movement)

Sebelumnya untuk target double top GU di posting sebelumnya

http://www.trendtrader.co.cc/2008/10/gbpusd-double-top-starting-for-new.html

sudah done (Area 1.4000) .GBP/USD saat sedang bersiap-siap melakukan bullish reversal.

Untuk pembentukan signal selanjutnya di GBP/USD masih menunggu konfirmasi.

Selagi menunggu signal dari GBP/USD, berikut gambaran kedepan pergerakan USD/JPY dan EUR/USD

1.USD/JPY

Terbentuk pola yang menarik dari USD/JPY yaitu symetrical triangle

USD/JPY berhasil break high dari trianglenya next target ada di titik B (96.25) yang mungkin dapat dicapai dalam jangka waktu 4-5 jam kedepan.

Sentuhan terhadap titik B tersebut akan memicu terbentuknya pola Double Top with bearish divergence antara titik A dan B (di harga) dan titik A dan C (di oscilator) pembentukan pola ini bisa memicu USD/JPY untuk kembali ke level 92.58 kembali.

2.EUR/USD

Setelah terbentuknya pola double top with bearish divergence di EUR/USD dengan take profit di area 1.2560 (posisi sell masih open), maka pergerakan selanjutnya yang mungkin terjadi di EUR/USD adalah sebagai berikut:

Jika EUR/USD dapat menyentuh titik B maka akan terbentuk pola double bottom with bullish divergence dan memberi peluang bagi EUR/USD untuk reversal secara besar-besaran ke level 1.3500 kembali.

Disclaimer:

Analisa diatas hanya merupakan pandangan pasar yang saya sesuaikan dengan gaya trading saya dan sama sekali bukan anjuran untuk mengambil posisi di market. Sesuaikan metode trading anda dengan gaya, kemampuan modal dan psikologis anda. Always manage the risk

Semoga bermanfaat

Kind Regards,

Aditya

http://www.trendtrader.co.cc/2008/10/gbpusd-double-top-starting-for-new.html

sudah done (Area 1.4000) .GBP/USD saat sedang bersiap-siap melakukan bullish reversal.

Untuk pembentukan signal selanjutnya di GBP/USD masih menunggu konfirmasi.

Selagi menunggu signal dari GBP/USD, berikut gambaran kedepan pergerakan USD/JPY dan EUR/USD

1.USD/JPY

Terbentuk pola yang menarik dari USD/JPY yaitu symetrical triangle

USD/JPY berhasil break high dari trianglenya next target ada di titik B (96.25) yang mungkin dapat dicapai dalam jangka waktu 4-5 jam kedepan.

Sentuhan terhadap titik B tersebut akan memicu terbentuknya pola Double Top with bearish divergence antara titik A dan B (di harga) dan titik A dan C (di oscilator) pembentukan pola ini bisa memicu USD/JPY untuk kembali ke level 92.58 kembali.

2.EUR/USD

Setelah terbentuknya pola double top with bearish divergence di EUR/USD dengan take profit di area 1.2560 (posisi sell masih open), maka pergerakan selanjutnya yang mungkin terjadi di EUR/USD adalah sebagai berikut:

Jika EUR/USD dapat menyentuh titik B maka akan terbentuk pola double bottom with bullish divergence dan memberi peluang bagi EUR/USD untuk reversal secara besar-besaran ke level 1.3500 kembali.

Disclaimer:

Analisa diatas hanya merupakan pandangan pasar yang saya sesuaikan dengan gaya trading saya dan sama sekali bukan anjuran untuk mengambil posisi di market. Sesuaikan metode trading anda dengan gaya, kemampuan modal dan psikologis anda. Always manage the risk

Semoga bermanfaat

Kind Regards,

Aditya

Jumat, 21 November 2008

Rabu, 19 November 2008

Jumat, 14 November 2008

Rabu, 12 November 2008

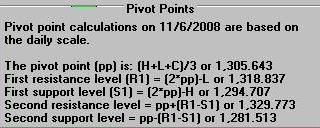

Kamis, 06 November 2008

Rabu, 05 November 2008

Selasa, 04 November 2008

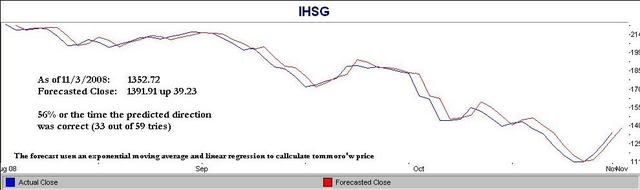

IHSG (Candlestick Analysis and Forecasted Close as per 11/4/2008

Senin, 03 November 2008

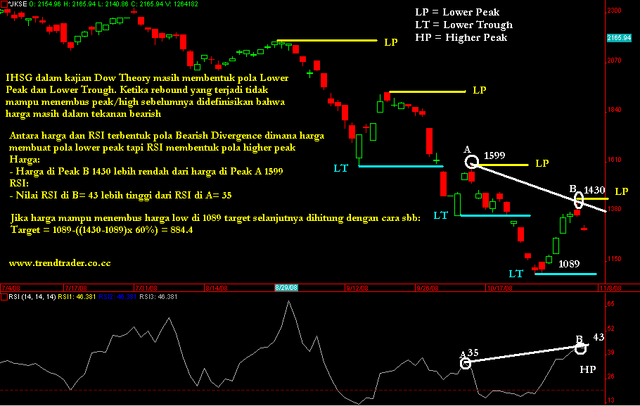

IHSG 3 Nov (Trendline & Bearish Divergence)

Sabtu, 01 November 2008

Trading Qoutes

The best traders I know are really quite brilliant, and they all work very hard - much harder than anyone else. By the way, when I talk about working hard, I mean commitment and focus: it has nothing to do with how many hours you spend in the office. These traders have tremendous commitment to the markets - to their craft so to speak. They develop scenarios, reevaluate scenarios, collect information and reevaluate that information. - BILL LIPSCHUTZ

We all go through periods when we’re out of sync with market. When I’m doing things correctly, I tend to expand my rate of involvement in the market. Conversely, when I start losing, I cut back my position size. The idea is to lose as little as possible while you’re in a losing streak. Once you take a big hit, you’re always on the defensive. In all the months I lost money, I always ended up trading small - sometimes trading as little as 1 percent of the account. - VICTOR SPERANDEO

You have to be able to think clearly and act decisively in a panic market. The markets that go wild are the ones with the best opportunity. Traditionally, what happens in a market that goes berserk is that even veteran traders will tend to stand aside. That’s your opportunity to make the money. - MARK RITCHIE

Trade infrequently and only when you have a strong idea. Trade the opposite side of the predominant news stories. Time your trade to coincide with an event that has the potential to lead to a panic climax. These are my three rules for directional trading. - BLAIR HULL

We all go through periods when we’re out of sync with market. When I’m doing things correctly, I tend to expand my rate of involvement in the market. Conversely, when I start losing, I cut back my position size. The idea is to lose as little as possible while you’re in a losing streak. Once you take a big hit, you’re always on the defensive. In all the months I lost money, I always ended up trading small - sometimes trading as little as 1 percent of the account. - VICTOR SPERANDEO

You have to be able to think clearly and act decisively in a panic market. The markets that go wild are the ones with the best opportunity. Traditionally, what happens in a market that goes berserk is that even veteran traders will tend to stand aside. That’s your opportunity to make the money. - MARK RITCHIE

Trade infrequently and only when you have a strong idea. Trade the opposite side of the predominant news stories. Time your trade to coincide with an event that has the potential to lead to a panic climax. These are my three rules for directional trading. - BLAIR HULL

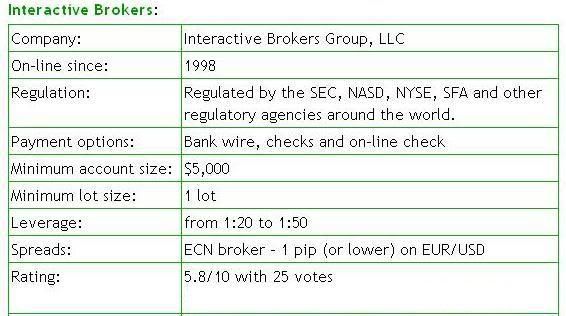

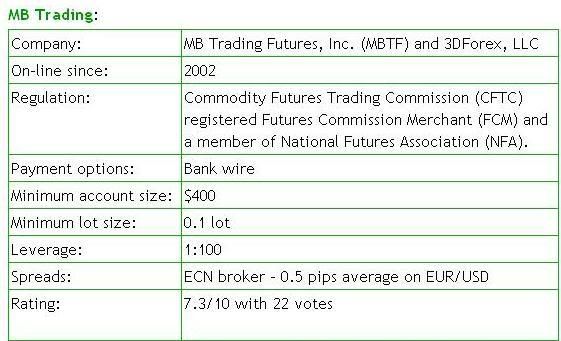

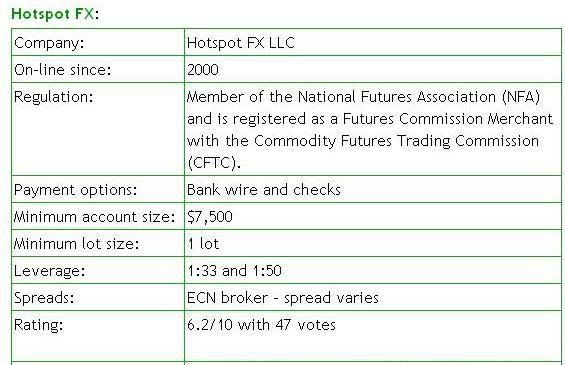

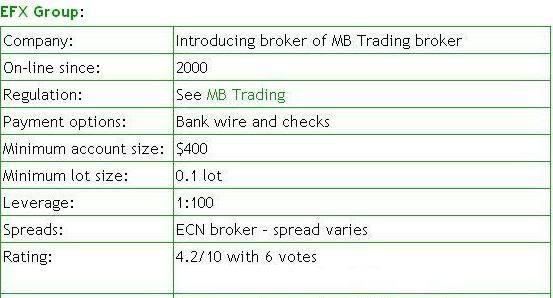

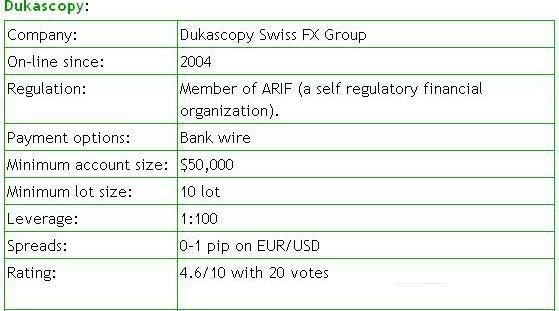

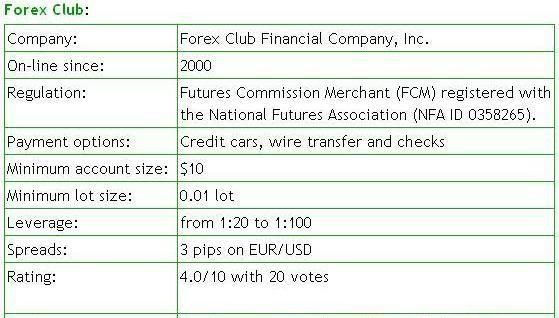

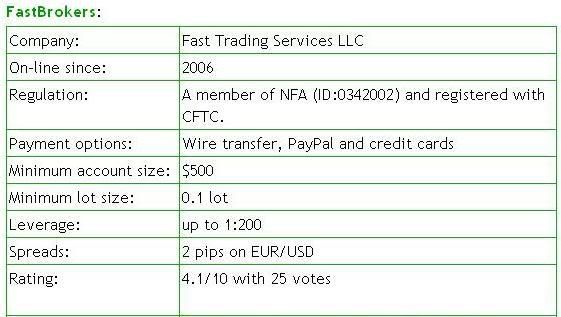

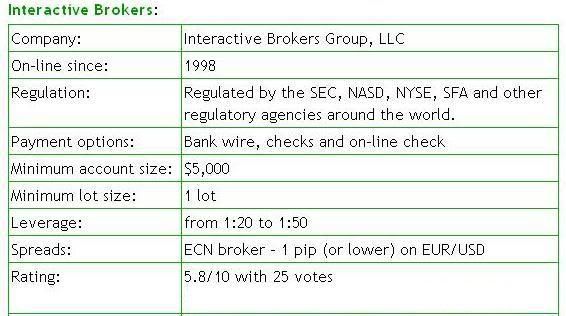

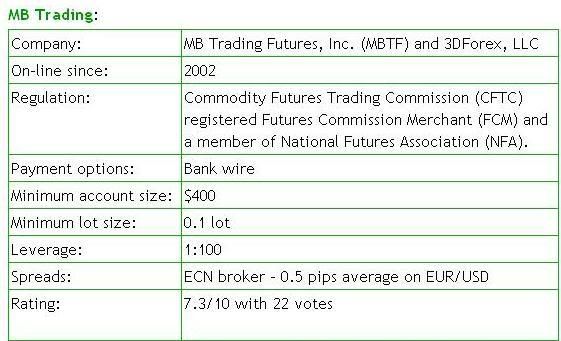

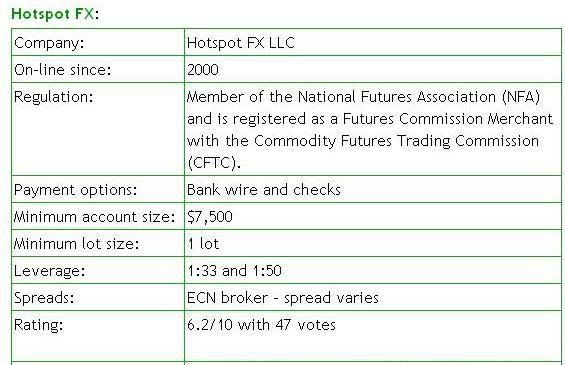

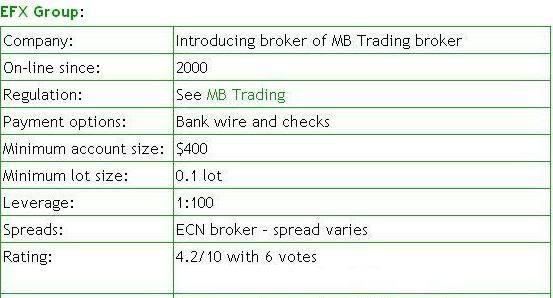

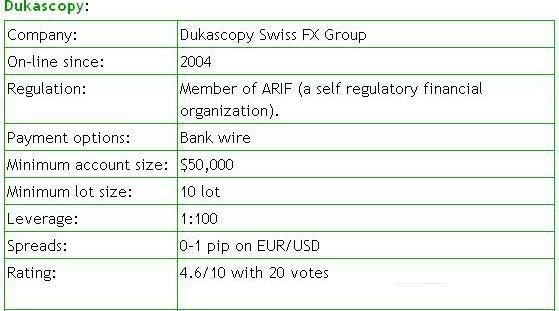

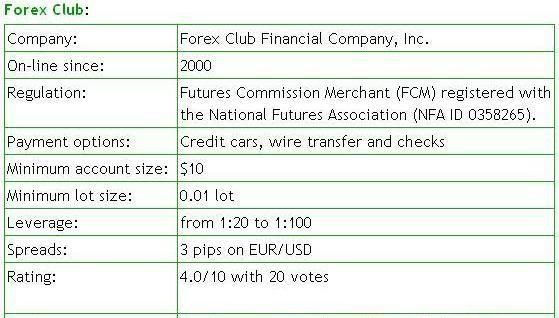

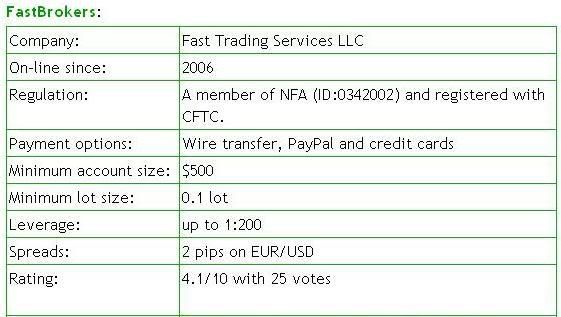

ECN Forex Brokers

A list of ECN Forex brokers which provide Forex traders with a direct access to other Forex market participants — retail and institutional. This results in some advantages — no anti-scalping, no «stop-loss hunting», very low spreads; and disadvantages — ECN brokers charge commissions for Forex trading.

Advantages:

Advantages:

Advantages:

Advantages:

Advantages:

Advantages:

Advantages:

source:

http://www.earnforex.com/ecn_forex_brokers.php

Advantages:

- ECN Forex broker - low spreads, perfect market conditions

- Repuatable company

- Universal account for Forex, Stock, Futures and Options trading

Disadvantages:

- No MetaTrader4 software support

- No demo account

- No mini Forex accounts

Advantages:

- ECN Forex broker

- Low, floating spreads

- Supports trading over the phone

Disadvantages:

- Commissions for trading

- No MetaTrader 4 software support

- Opening an account is a complicated process

- Residents of some countries can't open account

Advantages:

- One of leading ECN brokers

- Advanced trading platform

- MetaTrader 4 API integration is available

Disadvantages:

- No mini Forex accounts

- Account opening is a complicated process

Advantages:

- Low minimum ECN Forex broker

Disadvantages:

- No Metatrader 4 software support

Advantages:

- ECN Forex broker

- Low spreads

- A respected Forex company

- Advanced trading platform

Disadvantages:

- No mini Forex account

- Opening an account is a complicated process

- Very high minimum account size

Advantages:

- Advanced trading platform

Disadvantages:

- No Metatrader 4 software support

Advantages:

- MetaTrader platform available

Disadvantages:

- No important disadvantages

source:

http://www.earnforex.com/ecn_forex_brokers.php

Fixed spread broker vs ECN Broker

Fixed Spread Retail Brokers-

First the Pluses

Fixed Spreads (except news time)

Guaranteed Stops & Limits (except news times)

Guaranteed fills (excepts news times)

Low initial deposits

Now the Negatives-

Way to much leverage

Many re quotes

Low initial deposits

Encourage traders to over trade

Trade against you

ECN or commission based Brokers

Pluses

Very low spreads during non-news times

small initial deposits

Don't trade against you

No re quotes

Live interbank feeds allowing you to set your own price. Trading between spreads.

Negatives-

Commission can nullify spread savings

No guaranteed fills at anytime

No guaranteed stops or limits at anytime

Gaps in price will murder you.

These are the two main types of brokers. There are hybrids emerging these days. You want to do your due diligence in choosing a broker. If they are based in the USA check them out with NFA @ National Futures Association - NFA is a regulatory service provider for the derivatives markets & ask fellow traders.

Make sure that are have been around for at least 5 years & have a solid track record with the NFA & the CFTC. This is your money, protect it.

source:

http://www.forex-tsd.com/metatrader-brokers/14048-alpari-uk-mbtrading.html

First the Pluses

Fixed Spreads (except news time)

Guaranteed Stops & Limits (except news times)

Guaranteed fills (excepts news times)

Low initial deposits

Now the Negatives-

Way to much leverage

Many re quotes

Low initial deposits

Encourage traders to over trade

Trade against you

ECN or commission based Brokers

Pluses

Very low spreads during non-news times

small initial deposits

Don't trade against you

No re quotes

Live interbank feeds allowing you to set your own price. Trading between spreads.

Negatives-

Commission can nullify spread savings

No guaranteed fills at anytime

No guaranteed stops or limits at anytime

Gaps in price will murder you.

These are the two main types of brokers. There are hybrids emerging these days. You want to do your due diligence in choosing a broker. If they are based in the USA check them out with NFA @ National Futures Association - NFA is a regulatory service provider for the derivatives markets & ask fellow traders.

Make sure that are have been around for at least 5 years & have a solid track record with the NFA & the CFTC. This is your money, protect it.

source:

http://www.forex-tsd.com/metatrader-brokers/14048-alpari-uk-mbtrading.html

Langganan:

Postingan (Atom)